Annex Bulletin 2013-02 January 22, 2013

A partially OPEN edition

Apple Falls from Treetop (Analysis of latest market and business results of top 15 IT companies)

IBM FINANCIAL

Updated 1/22/13, 3:00PM HST

Analysis of IBM's Fourth Quarter Business Results

Steady As She Goes

IBM revenues decline in the quarter and for the year, but profits delight Wall Street; stock surges in after-hours trading

HAIKU, Maui, Jan 22, 2013 - "Steady as she goes," seems to be the theme of IBM's latest earnings release. Revenues are down but profits have exceeded the Wall Street estimates. So the stock is up in after hours trading.

After Hours : 204.98

8.90 (4.54%) 5:07PM EST

Which frankly is the biggest surprise in today's announcement. What's the Wall Street exuberance about?

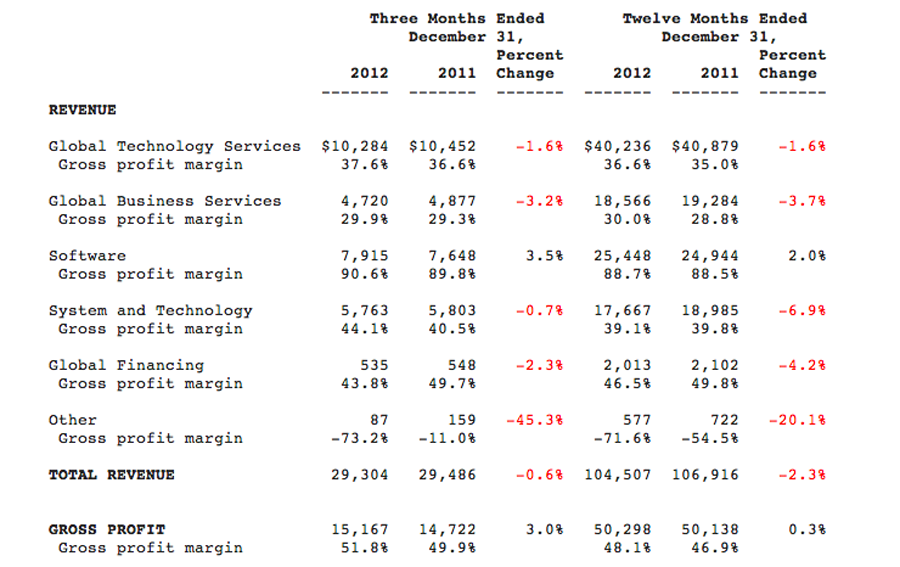

Just look at this summary of IBM's 2012 performance. The only area of growth, and a meager one at that, is software. EVERYTHING ELSE is red (meaning it is shrinking). We don't see anything different in this report that would suggest a positive change in IBM trends - from revenue declines to growth.

And even the gross profit, after all is said and done, is basically flat. So after all the "pruning" is done in the services area, there not much to show for in terms of the overall gross profit, either.

Plus, the new signings for GTS are down 28%, down 12% for IBM services overall. And that does not bode well for any quick future recovery of IBM's largest segment - services.

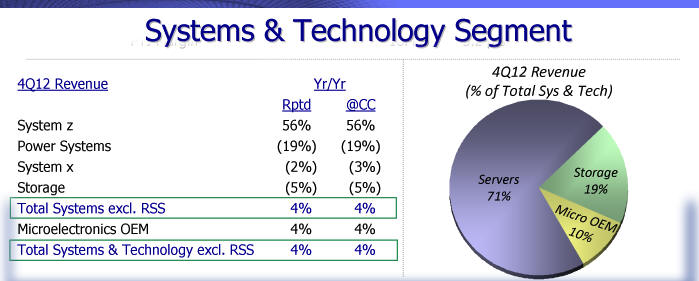

STG (IBM hardware) revenue continues to shrink, except for the new z (mainframe), of course, which had a banner quarter (revenue up 56%). But the z had been declining in the previous periods. So one big quarter obviously is not enough to make up for the shortfall from other business segments.

That's the downside.

The Upside

Now, here are also some

mitigating factors to consider as an upside that may be pushing the

stock price up tonight.

Growth in higher-value big data and analytics (13 percent ), cloud computing (80 percent), and Smarter Planet (25 percent) initiatives generated margin and profit expansion

-- 4Q operating gross (+2.1), pre-tax (+2.6) and net (+1.9) margins increased YTY-- 4Q operating net income up 10 percent-- 4Q Software gross profit margin of 90.6 percent-- Full-year 2012 software profit of $10 billion

-- Beat 4Q EPS and revenue street consensus outlooks.

-- 4Q12 operating EPS of $5.39 (up 14 percent) vs. consensus of $5.25.-- 40th straight quarter of YTY EPS growth

-- 4Q revenue of $29.3 billion vs consensus of $29.1 billion-- Revenue up 1 percent excluding divested Retail Store Systems adjusting for currency-- Software revenue up 4 percent adjusting for currency-- System z mainframe revenue up 56 percent

-- 10th straight year of double-digit EPS growth

-- Full-year operating EPS of $15.25 (up 13 percent) vs consensus of $15.13

-- Full-year free cash flow of $18.2 billion (up $1.6 billion)-- 4Q free cash flow of $9.5 billion (up $0.6 billion)

-- 2013 operating EPS expectation of $16.70 vs consensus of $16.63

SUMMARY

So what we are witnessing is a continuation of the "Quality over Quantity"-strategy that Sam Palmisano, IBM's former CEO, put in place in 2006. And the new CEO, Ginni Rometty, is evidently continuing. She is running IBM for the long haul not just quarter-by-quarter results.

So don't expect IBM to set the world on fire as Apple did with its iPhone or iPad products. "Steady as she goes," or "boring but dependable" may be better attributes when one thinks of Big Blue.

Here's an excerpt from what Ginni said herself about the latest results in a release:

"We achieved record profit, earnings per share and free cash flow in 2012... We are well on track toward our long-term roadmap for operating EPS of at least $20 in 2015."

By contrast just look at HP, for example. Not long ago that company claimed the pole position in the IT industry in terms of revenues. And its news has been anything but boring in the last several years. Almost like a soap opera. Alas, the industry's second oldest big company may be on its way to extinction. Because Wall Street is not into soap. And because HP failed to deliver on its bottom line promises.

So "steady as she goes" may not get you there as fast as some IT highflyers might. It will be get the IBM shareholders to $20 per share in 2015. That's a promise you can bank on.

Happy bargain hunting

Bob Djurdjevic

![]()

Volume XXIX, Annex Bulletin 2013-02 Bob Djurdjevic, Editor

(c) Copyright 2013 by Annex Research,

Inc. All rights reserved. |

Home | Headlines | Annex Bulletins | Index 1993-2013 | Special Reports | About Founder | Search | Feedback | Clips | Activism | Client quotes | Speeches | Columns | Subscribe

HP: Duped, Down and Out? (Analysis of HP's business and stock results)

Same Old Story, New Numbers Underscore Lack of IBM Growth (Analysis of IBM's third quarter business results)

Lack of Growth: IBM's Achilles Heel (Analysis of IBM's 2Q12 business results)

Apple Continues to Dominate (Analysis of top global IT companies' market and business results)

Big Blue Feet of Clay (Analysis of IBM first quarter results and long-term forecast)

Wall Street in Love! (No Signs of Caution on Ides of March, IBM Forecast Overshadowed by Wall Street Action)

Waning of PC Era Hurts HP (Analysis of latest HP business results)

Apple Leaves Everybody in Dust (Analysis of latest market and business results of top 15 IT companies)

Apple, IBM Clean Up, Google Stumbles (Analysis of fourth quarter business results of five major IT companies - Apple, IBM, Microsoft, Intel and Google)