Annex Bulletin 2005-20 November 15, 2005

An OPEN Client Edition

Updated 11/16/05, 9:30am MST (adds pSeries Shines)

![]()

IBM CORPORATE

Analysis of IBM’s Hardware Businesses: From Good to Better…

Hardware Revival

Third Consecutive Year of Growth; iSeries, pSeries – Growth Leaders Among Servers; Sale of PC Business Boosts Hardware Profitability

SCOTTSDALE,

Nov 15 – Things seem to be going from good to better in the IBM

hardware business. Last year,

we noted that a Big Blue “server renaissance” was under way. But not all

servers were firing on all cylinders a year ago (see “IBM

Server Renaissance,” Nov 2004).

This year, however, nearly all are.

And so are several other IBM hardware businesses.

Which makes the turnaround that started four years ago a full-fledged

“hardware revival”– the third consecutive year of organic growth.

iSeries.

The greatest and the swiftest turnaround took place in the iSeries

market.

Last year’s “problem child” has become the new IBM “poster

child,” a star performer with a 25%

revenue surge in the third quarter.

No wonder Mark Shearer, the iSeries GM, was this time the “leadoff

batter” among the hardware GM’s.

“We’re

getting the hearts of our business partners back into the iSeries game,”

Shearer told the consultants assembled in early November at the home of

“IBM brainiacs” – as one executive referred to the residents of the

60-year old Yorktown Heights research center.

The wooded site was aglow

in beautiful fall colors just as IBM was basking in renewed hardware and

research glory.

“It

(iSeries) is the single largest IBM hardware franchise,” Shearer added.

He pointed out that 58% of IBM server customers have at least one

iSeries installed, as do 98% of Fortune 100 companies.

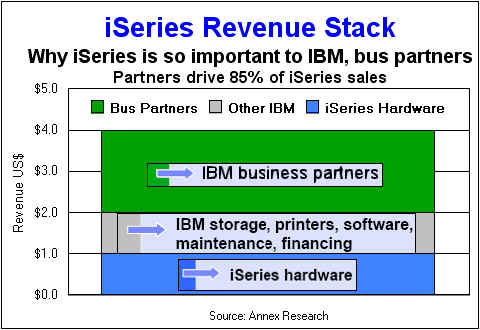

Of course, IBM did not do it alone. The iSeries business partners drive 85% of its sales. In many countries, they make more money on this IBM product than on any other server platform. We estimate that every iSeries system dollar generates two dollars for IBM business partners. No wonder they are flocking to it again, especially after IBM spent $1 billion in the last two years on iSeries innovation.

Within IBM, the iSeries is also more than

meets the eye (“i” – pun intended).

Every dollar of an iSeries system sale drags another dollar in

various IBM hardware, software or services revenue (see above chart).

With the demonstrable track record behind

him, no one doubted Shearer this time.

But when Mike Borman, the former iSeries GM, promised a turnaround a

year ago saying more or less the same thing, there were plenty of doubters

among the handful of consultants that filled the chairs in an iSeries

breakout session:

“Our technology is fabulous, (customer and partner) loyalty is strong, satisfaction second to none,” Borman told the IBM conference attendees in Austin last week.

Indeed. All key assets that had made the iSeries IBM’s, and maybe the IT industry’s, most successful franchise in history, are still in place. What’s needed is a marketing facelift. And Borman is determined to perform it.

“We will get there,” he assured some 500 or so Independent Software Vendors (ISVs) during a Nov 8 teleconference. “We will get this thing on track where it should be… as the premiere solutions box in the entire industry.”

(Borman quote from “Server Renaissance”)

Well, the iSeries “got there” indeed. Thanks to a relentless drive by Shearer and his marketing team that raised the public awareness by an unprecedented 20%, the iSeries is once again widely regarded as a “premiere solutions box in the entire industry.” (Shearer alone has visited 55 cities in 20 countries in the last 10 months, pressing flesh of both IBM business partners and customers; he spends 80% to 90% of his time on the road, he said).

As a result,

the iSeries is now once again winning hearts within IBM, too, as other

product lines are trying to emulate its formula for success.

Enter the Systems Agenda[1]… an Big Blue development

blueprint for the next five years.

“Rest assured that we are trying to completely hijack the Systems Agenda,” Shearer proclaimed only partially tongue-in-cheek. “The iSeries is its poster child… it’s at the very center of it.”

Looking ahead

to 2006, the bulk of the iSeries growth will come from SMB (small and medium

size business) and new clients, according to Bill Donohue, the head of

worldwide sales. The iSeries

team also intends to get “very aggressive” in developing markets, such

as Russia and China, for example, where “incubator programs” are being

set up.

Glad to see

that somebody is paying attention… (see New

"Drang Nach Osten" - global investment strategies, and Big

Blue Thinks Small - IBM's SMB strategy).

There will be “no ISV left behind,” declared boldly Joyce Bordash, head of the iSeries ISV (Independent Software Vendor) marketing, whose programs have already attracted some 2,600 ISV to the IBM solutions platform.

As a result, about 46% of the iSeries 2006 revenues is expected to come from SMB customers, and some 10% from new clients (also see “An iSeries Revival” special report).

pSeries.

The

pSeries was the second best-performing IBM hardware product line in the

third quarter, growing 15% over the same period a year ago (13% in constant

currency). What is the reason

for such a stellar performance in an otherwise fairly flat (Unix) market?

Big Blue is eating its competitors’ lunch, it seems.

“A lot of

traditional HP and Sun (Microsystems) customers are moving over to the IBM

platform,” asserted Adalio Sanchez, the head of the pSeries server line,

enabling IBM to claim the market share leadership position in the second

quarter of this year.

And the main

reason for that is that IBM is continuing to invest heavily into the Unix

platform and enhance it every 15 to 18 months.

“We are

completely committed to AIX (Unix),” Sanchez sought to reassure the

audience. “We are investing heavily in AIX.

We have (technological) road maps in place that will take us to 2014.

So the customers can have the piece of mind that we’ll be around

for them” in the long haul.

The unspoken

implication being that maybe the competition won’t?

Another

reason HP and Sun customers seem to be defecting in droves to IBM pSeries is

its price/performance advantage, even in large commercial applications.

That has not been a traditional strength of the pSeries, but appears

to have become one, thanks to its p5 technology running SAP, PeopleSoft and

Oracle software. In each of the

three instances, the pSeries claims a substantial price/ performance

advantage over HP and Sun, in that order (see the chart).

The pSeries

is also trying to acquire “more of the mainframe-type capabilities,”

Sanchez said. And it is actively promoting “Linux on Power,” its open

systems challenged to Microsoft and Intel (“Wintel”).

“We are offering a more robust Wintel environment but at (low) Wintel prices,” he summed it up.

As result, we expect the pSeries to continue to grow in double digits (13% this year), and finish up 2005 as one of IBM’s two brightest hardware stars.

pSeries Shines in Latest Benchmark Results

SCOTTSDALE, Nov 16 - IBM has just announced a new industry record benchmark result with the pSeries p5 570 16-core server, originally unveiled in July 2004. The IBM server surpassed Sun's Fire E6900 32-core score with half as many "engines." It also doubled Sun's 16-core Sun Fire V890 result (click here to view the results of the independent SPEC benchmarks).

IBM pSeries 64-core server has also shown a price/performance advantage of 47% over Sun's 72-core server, based on a performance 69% advantage.

The pSeries servers also top the list of the TPC-C benchmarks that measure simulated order-entry and distribution environment applications.

- A 4-way (4-core) IBM eServer p5 570 is the best-in-class 4-way system

- An 8-way (8-core) IBM eServer p5 570 is the best-in-class 8-way system

- A 16-way (16-core) IBM eServer p5 570 with IBM DB2 is the best-in-class 16-way system

- A 32-way (32-core) IBM eServer p5 595 with Oracle 10g database is the best-in-class 32-way

- A 64-way (64-core) IBM eServer p5 595 with IBM DB2 is the best overall system

Source: http://www.tpc.org

In short, the pSeries takes the cake no matter how you slice it. IBM's POWER4 systems, introduced in 2001, were the industry's first dual-core systems. The latest POWER5 and POWER5+ servers continue its performance and price/performance leadership. IBM has introduced over 70 industry-leading benchmark results since the original eServer p5 announcement.

xSeries.

The xSeries servers, IBM’s direct play in the Wintel market,

continue to grow in double digits rates (up 11% in the third quarter)

despite “difficult comparisons” to 2004 (meaning last year was an

excellent year for the xSeries). And

while traditional technology-driven servers, such as the pSeries, are

gravitating more toward the business solutions market, the xSeries seems to

be pushing its technological advantages over other vendors.

“Competitors are not publishing their performance data anymore because the gap (in IBM’s favor) has become so tremendous,” boasted Leo Suarez, a vice president of the zSeries product line. He proceeded to push his box on a speeds and feeds basis, the way Unix vendors used to sell their wares.

“That’s because that (xSeries) business

is getting commoditized,” explained one IBM executive to whom we had

expressed our bewilderment with the xSeries marketing strategy.

Nevertheless,

even here, or maybe especially here - in a commoditized environment - IBM

has been compelled to innovate.

“BladeCenter

is our best success story, Suarez said.

It has come to symbolize infrastructure simplification through

integration, he explained. “Bank

in a box,” an IBM financial industry solution based on BladeCenter, is a

case in point.

zSeries. Five years ago, the zSeries kicked off the Big Blue “server renaissance,” as the new IBM mainframes, dubbed zSeries, were launched. Since that time, the “z” has morphed from a dinosaur into a springbok, as we noted in our report “IBM Server Renaissance” – much to everyone’s surprise. Except for the two IBM leaders who engineered this amazing comeback story (see “IBM: Polaris Eclipses T-Rex,” July 2005).

“The idea

was to get to the next system idea first,” said Bill Zeitler, the head of

IBM Systems & Technology (i.e., all IBM hardware).

“We’ve

got to invent something,” Erich Clementi, the zSeries boss, impatiently

urged on his research advisor.

And so they

did. The result was the world’s most powerful mainframe – the

z9 – which Clementi personally unveiled on a New York stage (see July 26

photo - right).

“It was a

great action shot’,” Zeitler joked.

“It must have run in 500 newspapers.”

But more important action was yet to follow…

Ten of the

brand new 54-way mainframes were delivered ahead of schedule in the third

quarter due to strong customer demand, Clementi said.

And many more will be ringing the IBM cash registers in the fourth

quarter, as the zSeries factories go on full throttle in a traditional big

year-end push.

“What I

tell our folks (end users) is to go back to the mainframe,” said Andy

Geisse, the CIO of SBC, a telecom that has outgrown Verizon and become one

of the largest consumers and dispenser of IT power in the country, backing

up “z” strategy.

The reason?

“It’s up

practically 100% of the time,” Geisse answered his own rhetorical

question. “We never have any

issues with it. With midrange

servers, we started out assuming they would cost less.

Now they are a huge headache and a big cost issue.” (also see “Poughkeepsie

Spring” special report).

As a result

of an increasing number of large customers coming to the same conclusions as

SBC’s IT boss, we expect the zSeries to show modest growth in 2005, before

surging in double digits next year.

So 12 years

of revenue erosion will be followed by four years of growth.

That’s no flash-in-a-pan turnaround story anymore.

That’s a springbok in action.

From dinosaur

to springbok… quite a metamorphosis.

Even Charles Darwin might have never thought it possible.

This writer certainly did not a few years ago…

Storage,

Other Hardware.

“We believe storage spending will outpace other portions of IT by

two to three times,” Andy Moonshaw, the head of IBM storage, quoted a Banc

of America IT executive as saying in his presentation to consultants.

Judging by the industry growth rate of 6%,

which Moonshaw also cited, it would seem a stretch.

But IBM, if not everybody’s, storage is certainly growing at nearly

double the industry rate (up 11% in the third quarter).

Once again, it is the SMB market and midrange storage that are

providing the biggest impetus (also see “Big

Blue Thinks Small”, Nov 2005 – our analysis of IBM's SMB

strategy).

One factor

that’s driving the demand for storage as well as mainframes is

virtualization. As other vendors rush to embrace an IBM idea that large

customers find so appealing, Moonshaw warned, “virtualization is a very

easy thing to talk about; (but) it is a very hard thing to do.”

“And IBM has been doing it a very long time,” the IBM storage chief added, cited over 1,400 clients that have installed the IBM solution.

The only

areas with sub-par performance among the IBM hardware segments were the

leftovers from IBM’s sale of its PC business to Lenovo (printers and

retail store solutions – see the chart on page 4).

Not surprisingly, neither of them appeared on the Yorktown Heights

stage.

Outsourcing

R&D. One of IBM’s latest and most profitable inventions is the

invention business. Turning an

expense item (R&D) into a profit center (E&TS) has become an

innovation in and of itself.

“I

innovate; therefore, I am,” exclaimed Paul Horn, the head of IBM research,

who hosted the two-day conference at Yorktown Heights, in conclusion of his

presentation. He was playing off René Descartes’ [1596-1650]

famous quote, “I think, therefore, I am.”.

Horn’s line

should become the new Big Blue motto.

“It is

absolutely critical not only to invent, but also to innovate,” Horn also

asserted.

What’s

the difference?

Innovation

is an invention that makes money, according to IBM.

IBM’s

E&TS (Engineering & Technical Services) showed how it is done in the

Big Blue world. Its third

quarter revenues were up 68%, the fastest growth rate of any IBM unit, and

the eighth consecutive quarter of double-digit growth.

Try topping that!

Summary

The latest IBM results show that the “renaissance” we wrote about a year ago has spread well beyond the servers. Not only are nearly all Big Blue hardware segments growing; they are becoming more profitable after the money-losing IBM PC exited the scene. “Smaller and better” – is an apt summary of IBM hardware businesses’ “state of the union.”

Happy bargain hunting!

Bob Djurdjevic[1] The IBM “Systems Agenda,” launched with the z9 announcement on July 26, 2005, postulates: 1. Virtualize; 2. Open; 3. Collaborate to innovate;

For additional Annex Research reports, check out... 2005

IT: IBM

Hardware Revival (Nov 2005); Tap Dance

Lifts EDS Stock (Nov 2005); Big

Blue Thinks Small Is Big (Oct 2005);

Global

Investments: Yin-Yang Pacific Tsunamis (Oct 2005); IBM:

Springboard Quarter

(Oct 2005);

Top

Wall St Firms Bump Up Investments (Oct 2005); Accenture:

A Whopper Quarter

(Oct 2005); Global

Investments: New "Drang Nach Osten" (Sep 2005); HP:

Sweet Turnaround (Aug 2005); Dell

Spooks Street (Aug 2005);

EDS Ups Its Forecast

(Aug 2005); Capgemini

Beats Forecast (July 2005); Fujitsu:

Losses Reversed; Forecast Upgraded (July 2005);

IBM:

Polaris Eclipses T-Rex (July 2005);

IBM

Bounces Back

(July 2005); Accenture:

Smashing Records

(July 2005); Merrill's

New Bull (EDS)

(May 2005);

IBM

Trumps Trump

(May 2005);

Tweaking

Big Blue

(May 2005); Hurd's

First RBI (May

2005); Dell

Rings the Bell (May

2005); Stock

Buybacks: The Phantom Is Back (May

2005); EDS Misfiring

on All Cylinders (May

2005);

HP

Surges, Dell Slumps; Lenovo Completes IBM Deal

(May 2005);

Fujitsu

Revenues Flat, Lower Net

(Apr 2005);

Capgemini

Jettisons Healthcare in N.A.

(Apr 2005);

HP:

From India to Poland (Apr

2005);

IBM:

Slammed and Dunked (Apr

2005);

Hurd

Advice: Up Mount Market Cap (Apr 2005); Accenture:

Roaring Ahead (Apr

2005); Fujitsu

Unveils New Servers (Mar

2005); EDS

Executive Suite; HP's New CEO (Mar

2005); An

iSeries Revival (Mar

2005); EDS

Booster Club Fees Rise (Mar

2005);

An

Upside-Down View (Mar

2005);

The

Worst of Both Worlds

(Mar 2005); Octathlon

2005: Accenture Wins

(Mar 2005); IBM Global Services: Smaller,

Shorter - Better? (Mar 2005); IBM

5-yr Forecast: Quality over Quantity (Mar 2005); Rumor

Lifts EDS', Fujitsu's Shares (Mar 2005); Capgemini:

Turning the Corner (Feb 2005);

IBM

Servers to Grow Again (Feb 2005);

Carly's

Fickle Fans (Feb 2005); CSC:

Gearing Down on Purpose

(Feb 2005); EDS:

Grossly Overpriced Stock (Feb 2005); IBM

Historical Update: 2004 Shot in the Arm (Feb 2005); New

HeadTurners Series #1 (Feb 2005); IBM:

A Crescendo Finale! (Jan 2005); Accenture:

Strong Finish, Better Start (Jan 2005); Annex

Coverage 2004: IT Services Dominate (Jan 2005) 2004

IT: EDS:

The Titanium Stock (and other Wall Street tales)

(Dec 2004); IBM

PC: Good Riddance (Dec 2004); Fujitsu:

Recovery Continues (Nov 2004); IBM

Server Renaissance (Nov 2004); HP

Hits Home Run (Nov 2004); Capgemini:

Revenue, Stock Soars (Nov 2004);

EDS:

Jordan's Swan Song? (Nov 2004);

To Russia with

Love and $ (Oct 2004);

IBM: Slow

Quarter No Longer (Oct 2004); Accenture:

Revenues, Profits Up, Stock Down (Oct 2004);

Capgemini:

A Takeover Target? (Oct 2004); Sellout

of America (Oct 2004); Spy

Wars (Sep 2004);

Outsourcing

Boomerang (Sep 2004);

EDS

to Cut Up to 20,000 More Jobs (Sep 2004); Capgemini

Stock Plummets on Unexpected Loss (Sep

2004); HP

Savaged by Wall Street (Aug 2004); Moody's

Lowers the Boon on EDS (July 2004); HP:

Delivering Value Horizontally (June 2004);

Accenture: Revving Up a Notch (June

2004); Beware

Your CFO! (May 2004); IBM:

Changing of the Guard (May 2004); Capgemini:

Texas-size Home Run (May 2004); Following

the Money (May 2004); EDS:

On a Wink and a Prayer (Apr 2004); HPS

Wins by a Nose! (Octathlon 2004); Accenture:

Burning the Track (Mar 2004); IGS:

"Crown Jewel" Restored? (Mar 2004); HP:

Still No Cigar (Feb 2004);

Cap Gemini: Another, Smaller Loss

(Feb 2004); CSC: Good Quarter Gets Boos (Feb

2004); EDS:

"Hot Air Jordan" Flaunts Flop as Feat (Feb 2004); IT

Industry: Whither Goeth It? (Jan 2004); Cronyism

Is Alive and Well at EDS" (Jan 2004) Or just click on Volume XXI, Annex Bulletin 2005-20 Bob Djurdjevic, Editor 8183 E Mountain Spring Rd, Scottsdale,

Arizona 85255 The copyright-protected information contained in the ANNEX BULLETINS

and ANNEX NEWSFLASHES is part of the Comprehensive Market Service (CMS). It is intended for the exclusive use

by those who have contracted for the entire CMS service. Home |

Headlines | Annex Bulletins

| Index 2005 | About

Founder | Search | Feedback

| Clips | Activism

| Client quotes | Workshop | Columns

| Subscribe ![]()

![]()

and use appropriate

keywords.

and use appropriate

keywords.

November 15, 2005

(c) Copyright 2005 by Annex Research, Inc. All rights reserved.

e-mail: annex@djurdjevic.com

TEL/FAX: (602) 824-8111

![]()